How to Use Fibonacci Retracement Levels in Forex Trading

Fibonacci retracement is a popular technical analysis tool used by forex traders to identify potential levels of support and resistance in the market. By understanding and applying Fibonacci levels, traders can better predict price movements and make more informed decisions. In this article, we’ll explain how Fibonacci retracement works and how you can use it in forex trading.

1. What Are Fibonacci Retracement Levels?

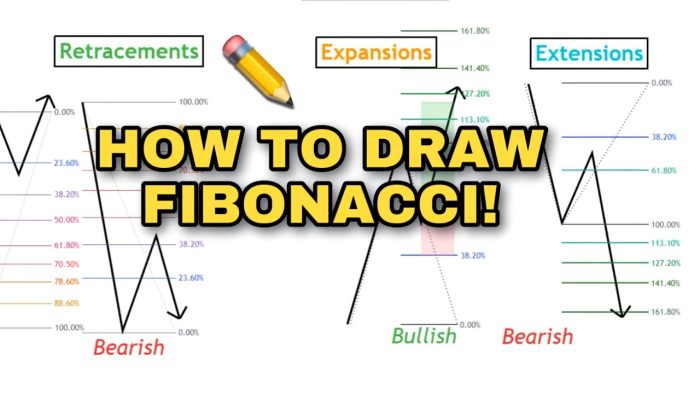

Fibonacci retracement levels are horizontal lines that indicate areas of support or resistance at key levels based on the Fibonacci sequence. These levels are derived by taking the high and low points of a price move and applying the key Fibonacci ratios. The most commonly used Fibonacci retracement levels in forex are 23.6%, 38.2%, 50%, 61.8%, and 100%.

The idea behind Fibonacci retracement is that after a significant price movement, the market will often retrace a portion of that movement before continuing in the original direction. These retracement levels help traders identify potential reversal points where price may bounce or stall.

2. How to Use Fibonacci Retracement in Forex

To use Fibonacci retracement in forex trading, follow these simple steps:

- Identify the Trend: Determine the direction of the current trend (uptrend or downtrend) by analyzing the price chart.

- Choose the Swing Points: For an uptrend, select the low point and the high point of the move. For a downtrend, choose the high point and the low point.

- Apply the Fibonacci Tool: Use the Fibonacci retracement tool on your charting platform to draw the retracement levels between the swing points.

- Look for Entry Signals: Once the Fibonacci levels are drawn, look for price action near these levels. If the price retraces to a significant Fibonacci level and shows signs of reversal (such as candlestick patterns or other indicators), it may be a good time to enter a trade in the direction of the trend.

3. Common Fibonacci Retracement Strategies

There are several strategies traders use with Fibonacci retracement levels to improve their chances of success:

- Trend Continuation: In a strong trend, price often retraces to one of the Fibonacci levels before continuing in the same direction. Traders can enter a buy trade in an uptrend or a sell trade in a downtrend when price shows signs of bouncing off a key retracement level.

- Breakout Strategy: When price breaks through a Fibonacci retracement level, it can signal a continuation of the trend. Traders can look for confirmation of the breakout before entering a trade.

- Multiple Confluence Levels: If multiple indicators or price patterns align with a Fibonacci level, it can provide a stronger signal. For example, if a Fibonacci retracement level coincides with a support/resistance zone or an overbought/oversold condition, the trade signal may be more reliable.

4. Limitations of Fibonacci Retracement

While Fibonacci retracement levels can be a valuable tool in forex trading, they are not foolproof. Like all technical indicators, Fibonacci retracement works best when used in conjunction with other analysis methods, such as trend analysis, price action, and volume. Relying solely on Fibonacci levels without considering other factors can lead to poor trading decisions.

Fibonacci retracement levels are a powerful tool in forex trading that can help identify potential support and resistance levels, providing traders with valuable insights into price action. By understanding how to apply and interpret these levels, traders can enhance their trading strategies and improve their chances of success. However, it’s important to use Fibonacci retracement in combination with other analysis methods for more accurate results.

For more tips and resources on forex trading, visit https://iamforextrader.com/en/.